Trade & investment

When thinking big it pays to start small

In advance of the 2015 G20 leaders' summit, International Chamber of Commerce (ICC) Secretary General John Danilovich looks at the need for world leaders to take urgent action to support SME growth.

There is a famous saying about London buses that you wait hours for one and then three come along at once. Observers of international affairs may have a similar feeling this year, with an unprecedented string of global summits set to take place over the coming weeks.

Most dispatches from these gatherings of the great and the good will focus on the “big” issues: big names, big ideas, and big commitments to reform and revitalize the global economy. In just a few days’ time, leaders of the world’s largest economies will gather in Antalya, Turkey, for perhaps the most strategically important meeting in this jam-packed calendar: the 2015 G20 Summit. Given the scale of the challenges facing the global economy, it’s certainly incumbent upon the leaders of the G20 to think big-but in doing so it’s vital that they start small.

It has become somewhat of a cliché since the financial crisis to describe small- and medium-sized enterprises (SMEs) as the backbone of the global economy. But the figures show this to be an incontrovertible truth: globally 95 percent of enterprises are SMEs, representing around 60 percent of private sector jobs. In Europe, official estimates suggest that SMEs play an even greater role in promoting employment and social cohesion-providing two out of every three jobs in the private sector.

SMEs must therefore be centrally positioned in the efforts of the G20 to remedy the almost chronic problems of sluggish global growth and record levels of youth unemployment. To be clear: after years of well intentioned rhetoric, 2015 must be the year of action to support small business growth.

One urgent matter that should be of particular concern to all G20 leaders is the financing of small businesses. Without financing companies cannot grow and hire new people. Recent research shows that the enormous potential of small businesses is being held back by limited access to reasonably priced finance.

SMEs must therefore be centrally positioned in the efforts of the G20 to remedy the almost chronic problems of sluggish global growth and record levels of youth unemployment. To be clear: after years of well intentioned rhetoric, 2015 must be the year of action to support small business growth.

For example, SMEs often rely on bank credit to allow them to export, but new data shows that over 50 percent of SME applications for trade finance are now turned down by banks. The Asian Development Bank estimates that there is currently a US$1.4 trillion shortfall in trade finance globally-and SMEs, which typically have little access to alternative forms of financing, are clearly suffering most acutely from this yawning gap.

Banks need to be prudent and financial regulation is, quite rightly, more demanding today than it was before the financial crisis. But if the G20 is serious about creating jobs, we must urgently help deserving businesses get financing for their viable investments.

A useful starting point for the G20 would be to commit to exploring whether the implementation of tougher financial regulation has inadvertently stymied the flow of finance to small businesses. In addition, it is time to consider how SME access to alternative forms of financing can be improved. Alternative financing instruments do not come without a degree of risk, but given the scale of the credit drought faced by small businesses all policy options must now be put on the table and given due consideration.

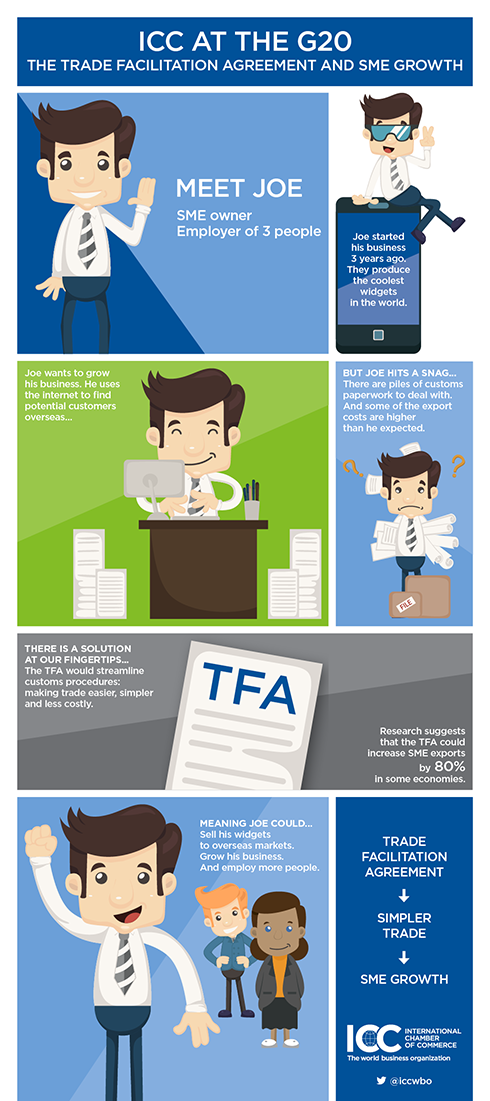

Another priority for the G20 must be to make it easier for SMEs to trade across borders. Inefficient border and customs processes place a significant brake on cross-border commerce in many countries: disrupting international supply chains, raising costs to both businesses and consumers, and all too often discouraging SMEs from entering overseas markets. World Bank research shows that the longer it takes to get goods across borders, the more exporting is dominated by large firms.

The good news is that there is a ready solution to this problem at hand. The World Trade Organization’s Trade Facilitation Agreement (TFA)-agreed in 2013 but ratified by only 51 governments to date-could have a transformational impact on the ability of SMEs to access global markets by reducing unnecessary red tape at borders.

G20 leaders must do all they can to speed the implementation of the TFA, which trade experts have suggested could more than double SME exports-creating some 21 million jobs in the process. Finding ways to boost investment in trade-related infrastructure-ports, roads, railways and the like-would further enhance the impact of this landmark agreement.

While it’s incumbent on world leaders to take action to support small businesses, governments should not feel that they need to shoulder this burden alone. During my tenure as the head of the International Chamber of Commerce-the world’s largest business organization-I’ve made it clear that we are ready and willing to support all efforts to turbocharge SME growth. Earlier this year, for instance, we launched the World SME Forum: a groundbreaking global initiative to build capacity within the small business sector.

The leaders of the G20 have a unique opportunity to support this agenda later this week in Antalya. Our message is simple: think big but start small to kick-start growth, job creation and a more prosperous future for all.

Follow @johndanilovich at the #G20 Summit.