Banking & finance

New ICC report confirms trade & export finance are not risky business

The low credit risk level of trade and export finance products continues to compare favourably to that of similar asset classes, shows the 2017 ICC Trade Register.

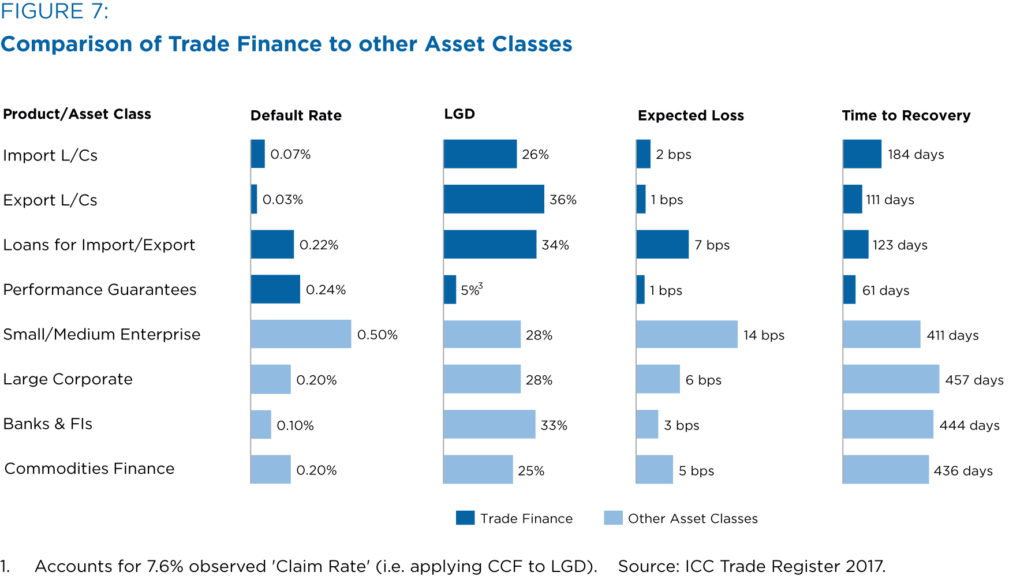

Default rates for a range of trade finance products ranged from 0.03% to 0.24%, demonstrating the extremely low level of credit default risk such activities present banks and other financial institutions, according to the 2017 ICC Trade Register—the authoritative annual report from the ICC Banking Commission.

This compares favourably to the credit risk posed by other banking activities, such as enterprise lending, despite the inference from some financial regulations that these asset classes are equally risky.

The 2017 Trade Register also found that time to recovery—the period it takes banks to recover their loans—is exceptionally short for trade finance products. The average time to recovery for trade finance products is 120 days, compared to 437 days for other asset classes.

Overall risk in export finance also remains very low despite a slight increase in expected losses driven by a small rise in default rates, especially considering its backing by export credit agencies.

“The 2017 Trade Register reiterates what we have seen year on year since the project was initiated in 2009: that trade finance is a reliable and low-risk asset class that should be looked upon favourably by regulators, industry stakeholders and investors,” said Daniel Schmand, Chair of the ICC Banking Commission and Global Head of Trade Finance at Deutsche Bank.

20 million trade finance transactions

Initiated in 2009, ICC’s Trade Register is the only authoritative source of trade finance and export finance-related credit risk and default data. Published annually, the report aims to underpin an objective dialogue on trade finance policies between practitioners and regulatory authorities around the world.

The 2017 report, produced with support from ICC’s project partners—The Boston Consulting Group and Global Credit Data—draws on information from 22 member banks to present a global view of the credit risk profiles of trade and export finance transactions. It is based on over US$10.5 trillion of exposures and more than 20 million trade finance transactions from 2008 to 2016—constituting approximately 40% of global traditional trade finance flows. The trade finance products in the register are import letters of credit, export letters of credit, loans for import/export, and performance guarantees.

A strong basis for smart regulation

As the scope and depth of financial regulation has expanded following the global financial crisis, some new rules have had the unintended consequence of making it difficult for banks to viably provide trade finance services, which are nonetheless vital for economic growth and development. Regulations published by the Basel Committee, for instance, have the potential to increase the capital requirements for banks, even for activities like trade financing with negligible levels of risk.

“ICC’s new data on the low credit risk of trade and export finance products comes at a crucial time, as Basel III rules will need to be translated into national law in the run-up to their implementation in 2020,” said Krishnan Ramadurai, the new Chair of the ICC Trade Register project.

“The Trade Register data provides a strong basis for a differential treatment of trade and export finance products under banking regulation,” added Mr Ramadurai.

As the Trade Register project continues to evolve in the future, ICC will seek to bring new banks on-board, as well as to extend its coverage to new products, such as supply chain finance.